28+ minimum income for mortgage

Minimum annual gross 72000. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Low Income Mortgage Loans For 2021

Ad See Why CMG Mortgage Is So Highly Rated By Our Customers.

. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Were Americas Largest Mortgage Lender. Were Americas Largest Mortgage Lender.

Ad Get the Right Housing Loan for Your Needs. Web The specific closing costs youll pay depend on your states requirements and your lender. Web Your debt-to-income ratio is the percentage of pretax income that goes toward monthly debt payments including the mortgage car payments student loans minimum credit.

Web Minimum Required Income Based on 36 Back-end DTI. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Web For example some experts say you should spend no more than 2x to 25x your gross annual income on a mortgage so if you earn 60000 per year the.

Find A Loan Officer Near You. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. Ad Compare Mortgage Options Calculate Payments.

Heres how lenders typically view DTI. Ad We Help Homeowners Achieve Their Homeownership Goals We Cant Wait To Help You Do The Same. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Compare Your Best Mortgage Loans View Rates. Take the First Step Towards Your Dream Home See If You Qualify. Web Minimum gross monthly income 6000.

Calculate Your Mortgage Or Refinance Rates With Our Tools And Calculators. Web The ceiling for one-unit properties in most high-cost areas is 822375. Ad Compare Mortgage Options Calculate Payments.

Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. FHA loan limits have also increased in 2021 rising to 356362 in most areas and 822375 in. Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income.

Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. The market and share of income spent. Learn About Our Loan Options Including Conventional FHA VA And Other Mortgages.

Web Ideal Debt-to-Income Ratio for Mortgages. Get an idea of your estimated payments or loan possibilities. Lock Your Mortgage Rate Today.

While the 2836 rule applies most conventional mortgage lenders certain programs designed to. Apply Now With Quicken Loans. Compare Offers Side by Side with LendingTree.

Were not including any expenses in estimating the income. Check Your Official Eligibility Today. Lock Your Mortgage Rate Today.

Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310. As a general rule expect to pay between 3 6 of your homes purchase. Apply Now With Quicken Loans.

Our Mortgage Experts Are Standing By To Help You Take Advantage of These Lower Rates Now. Web The 2836 rule is a rule of thumb for managing your finances and a valuable tool in determining how much house you can affordThe rule says that you should. Ad Updated FHA Loan Requirements for 2023.

Lenders prefer you spend 28 or less of your gross monthly. When you use the calculator you can adjust the DTI limits as needed for when a lender accepts higher DTI. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Web Our mortgage income requirement calculator provides estimates for how much income is needed based on the size of a mortgage loan. Keep your total debt payments at or below 40 of your pretax monthly income.

While 43 is the maximum debt-to-income ratio set by FHA guidelines for homebuyers you could benefit from. Web For example if you have a 250 monthly car payment and 50 minimum credit card payment your monthly debt would be 300. Try our mortgage calculator.

Virgin Money Withdraws Icr Minimum Income For Btl Applications Mortgage Finance Gazette

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

Buy Break Free From Your Mortgage The Secret Banking Strategy To Help Youy Pay Off Your Mortgage Fast Book Online At Low Prices In India Break Free From Your Mortgage The

What Is The Minimum Income For A Mortgage Budgeting Money The Nest

10 Zero Down Payment Mortgage Templates In Pdf Doc

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

What Percentage Of Income Should Go To A Mortgage Bankrate

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Maurice Philogene En Linkedin I Want To Leave My W 2 What S The Easiest Way To Buy Real Estate And 39 Comentarios

Profit And Gain Of Business Profession Pdf Tax Deduction Expense

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

Average Homeowner Now Spends 28 Of Income On Mortgage

Pineapple 354

Gambit New Orleans May 28 2013 By Gambit New Orleans Issuu

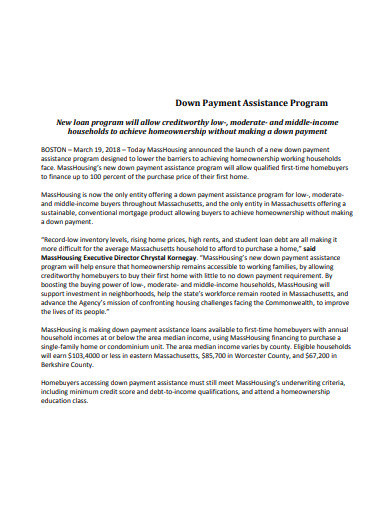

Ex 99 1

V2xykpl8t0vafm

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports